SVB’s rescue means the Fed won’t hike rates in March, says Goldman Sachs

After a frantic regulators-to-the-rescue weekend that sparked a rally for U.S. equity futures on Sunday night, the atmosphere has turned gloomier, with lots of banks in the red ahead of Monday’s open. Oil prices are also under heavy pressure as investors flock to gold, silver and the yen.

Nervous investors may be wary of more shoes dropping following the Silicon Valley Bank fallout that is resurfacing great financial crisis memories for some more long-toothed traders. And no rest for the wicked as the next update on consumer prices hits Tuesday.

Here’s Jim Reid and a team of strategists at Deutsche Bank, neatly summing up a whirlwind few days: “SVB’s woes are a combination of one of the largest hiking cycles in history, one of the most inverted curves in history, one of the biggest bubbles in tech in history bursting, and the runaway growth of private capital. The one missing ingredient not involved here is a U.S. recession.”

It’s just more of the boom-bust cycle we’re stuck in, says Reid. “That being… too much stimulus -> very high inflation and an asset bubble -> aggressive central bank hikes -> inverted curves -> tighter lending standards/accidents -> recession.”

Onto our call of the day from Goldman Sachs, where economists say the rescue of SVB and other depositors will tie the Fed’s hands next week.

“In light of recent stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March,” said a team led by chief economist Jan Hatzius in a note to clients late Sunday.

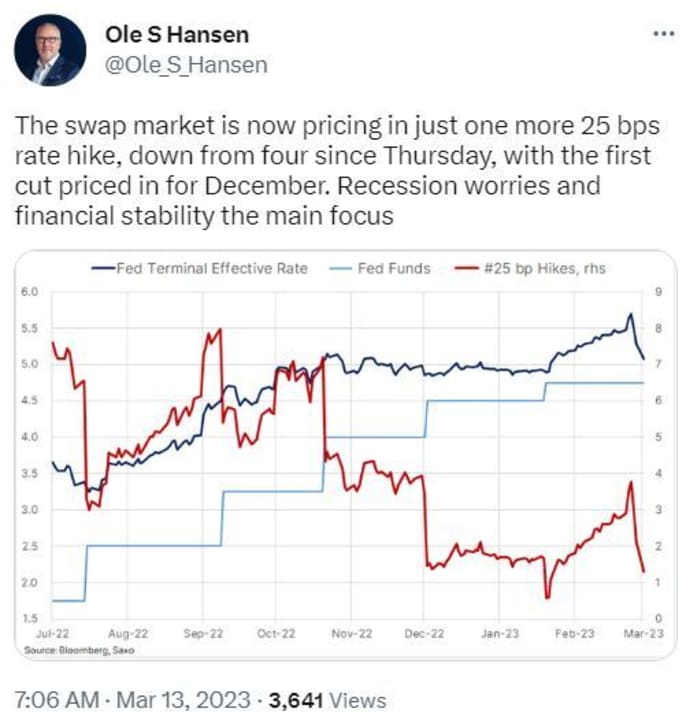

Hatzius and Co. had expected a 25-basis point hike next week. “We have left unchanged our expectation that the FOMC will deliver 25bp hikes in May, June and July and now expect a 5.25-5.5% terminal rate, though we see considerable uncertainty about the path,” they said.

They clearly aren’t alone as Fed fund futures indicate the chances of the Fed hiking interest rates by 50 basis points next week have fallen from 70% to zero in recent days.

But some say the Wall Street banking behemoth is getting ahead of itself:

Capital Economics, meanwhile, is siding with Goldman here: “Even if the authorities are successful at putting a firewall around the problems at SVB and Signature Bank, the lags with which policy operates are a reason to adopt a more gradual approach to policy tightening from here,” said Neil Shearing, group chief economist.

Note, Goldman also said that while the Fed has stemmed the panic over SVB and Signature Bank, it remains to be seen whether the FDIC would similarly address other such lenders if they were smaller than the two banks in question.

READ MORE HERE