ENCOURAGING ANGELS: What Do Undocumented Migrants, the Border States of Florida and Texas and the Crashing Value of Commercial Real Estate Have to Do With Catastrophic Risk to Your Financial Assets? A Lot…

Image Credit: On The World Map

By Stan Szymanski

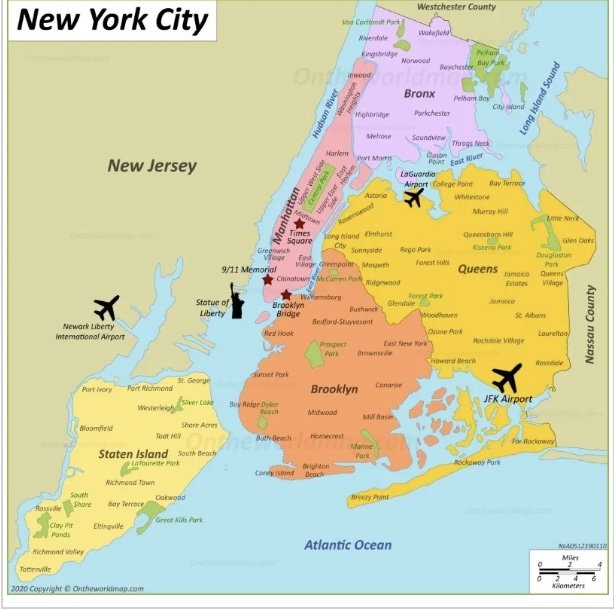

The mayors of the largest cities are now crying ‘uncle’ as the cities and metropolitan areas of New York, Chicago and more are starting to collapse under the weight of an international confidence game orchestrated by the powers that be. Carried out by Border States and Governors, with a helping hand from the UN (and IOM) they use a lot of US taxpayer dollars (the US funds 28% of the UN budget) to fund the movement of immigrants from one country and even continent, to the US.

My impression is, while these mayors of large US cities cry foul, they are in fact playing the part in this enterprise that they have been given. One of the main effects of the acceptance (and not rejection) of these multitudes is the crippling effect it is having on the Commercial Real Estate (CRE) market. Higher interest rates, the effects of Covid-19 and people working from home also play a part in the problems of the current CRE market. But the impact of the border crisis on CRE is broad and considerable.

…’New York City has been grappling with an influx of asylum seekers for the past 18 months, but city leaders are still approaching the crisis as if it were an emergency. It’s an emergency that the commercial real estate industry is largely sidelined (emphasis added) for, awaiting direction from public officials. … Mayor Eric Adams has consistently warned that a continued surge of migrants will “destroy” New York City, forcing him to make painful budget cuts. (Commercial Observer)

Perhaps it was a ‘Freudian Slip’ that Mayor Adams used the word ‘destroy’ when talking about the impact of the immigrants on NYC. But it most certainly is destruction that is happening in the largest cities of America due to the exporting of the crisis from the US borders into the city limits of Gotham and more. As the article stated-Commercial Real Estate (CRE) is sidelined by the migrant crisis. In my point of view, the ‘sidelining’ is more than temporary and it purposeful and by design.

How did all these ‘migrants’ get from wherever they crossed into the US at and all the other states and major cities in America? A lot of it was facilitated by United States governors…

Who can forget Desantis facillitating the safe passage of large numbers of the aliens out of Florida (‘Desantis Vows Florida Will Transport More Migrants to Other States’)?

Of course the MSM (Main Stream Media) was all about using the ‘controversy’ to foment more of a divide of the country (After Republicans Escalate Bussing Scheme, White House Condemns Chaos). This of course helps to make one half of the country be at odds with the other half over an issue that is, for all intents and purposes, a smoke screen to fool the general populace.

In reality, was the real issue a political scrap, or was it multiple levels of deception used to accomplish the goal of moving a population of undocumented, generally military age men of unknown background and moral character into the largest metropolitan areas of these United States?

___________________________

Please refer to our proviso at the end of the article regarding any reproduction of this writing and consider a donation to Encouraging Angels today. We need your support

—————————————-

Who can forget the mayor of Chicago decrying the burden of the busses of immigrants coming from Texas (Chicago Mayor Says Abbot Causing ‘Chaos’ by Sending Migrant Busses)? If you read this article IMHO, you will see that (Chicago Mayor) Brandon Johnson is not upset that the invading force is there; he is upset that Abbot just didn’t coordinate it with him and the powers that be first and give him at least a few days to prepare for them:

…’Johnson accused Abbott of being “afraid and mad” at the migrant situation at the southern border and acknowledged the difficulty Abbott faces. The problem, Johnson said, is the lack of coordination between Abbott and the officials running the cities to which he is sending the migrants.’…(Yahoo News)

In New York, Mayor Eric Adams issued ‘Emergency Executive Order 538’. Even though Politico opined that it was to restrict the migrant bussing from Texas to NYC, it was nothing of the sort. I am not a lawyer (and this is not any type of legal advice)-Executive Order 538 issued by Mayor Adams was basically written to -facilitate- the receipt of said immigrants-not to repel them or Ellis Island forbid-deport them.

In fact Executive Order 538 asks the transporters of said immigrant to tell the city when they are coming and to just give them a few days of notice and a little information (are they men, women or children and how many).

…’(a) Notification. Any such operator must provide notice of the anticipated date and time of arrival of their charter bus in New York City and the information required by paragraph (b) of this section to the Commissioner of Emergency Management or their designee (“the Commissioner”) by emailing busnotices@oem.nyc.gov at least 32 hours in advance of such anticipated date and time of arrival, except as provided in paragraph (e) of this section.’…(from Mayor Adams ‘Executive Order 538’)

And if the transporter wants immunity from providing even that little bit of information, why they can ask NYC for an -exemption- (Section 2 (e)) from providing even that much information about the new -guests- in The Big Apple.

The mayors of the biggest cities are not, IMHO, refuting or refusing the hordes of undocumented foreigners. They are complying with deliveries of human cargo that were arranged by Republican governors of two border states. Are other states and governors involved?

Getting back to the commercial real estate issue: The border crisis is manifesting its contribution to the speedy decay of the property values of the biggest buildings in our biggest cities. Less than two weeks ago I wrote about the Commercial Real Estate (CRE) debacle with the NYC Blackrock property. Do you really think that the people who rent space in Billion dollar properties can’t read the tea leaves? What tenant is going to stick around once people are employed as ‘pooper-scoopers’ to service the area outside the front door of the Billion dollar property?

In ‘SL Green, RXR’s Worldwide Plaza value cut by $500M’, the authors state that Worldwide Plaza underpins a $940 Million loan:

…’SL Green and RXR Realty’s Worldwide Plaza could find themselves in a world of hurt if two of its biggest tenants jump ship.

Wall Street securities firm Evercore ISI recently reported an implied value for the Midtown Manhattan complex of $1.2 billion, down nearly a third from $1.7 billion in 2017, according to Crain’s. The estimated valuation breaks down to $600 per square foot.’…(The Real Deal)

One of the building tenants at Worldwide Plaza is Japanese financial firm, Nomura who is also considering its options.

How bad is the sink hole that is known as CRE? Foreign banks are more forthcoming with the valuation of their American CRE holdings than their U.S. counterparts, IMHO. In ‘Second Domino Drops in Commercial Real Estate Market as Japanese Bank Slashes Value of Its American Office Holdings’ author Russell Payne states:

…’Signs of a long-predicted commercial real estate crisis are beginning to bubble up as Aozora Bank, the 16th largest bank in Japan, became the second bank in two days to warn of growing losses from their portfolios of American office buildings. … For Aozora, loans for American office buildings accounted for about 6.6 percent of its portfolio, or around $1.89 billion. The bank said that 21 loans in their portfolio, accounting for $719 million, were not performing (emphasis added).’ …(The New York Sun)

More than 1/3 of the loans in Aozoras’ portfolio of US CRE are-not performing-.

What is a ‘non-performing’ loan you ask?

…’A nonperforming loan (NPL) is a loan that is in default due to the fact that the borrower has not made the scheduled payments for a specified period. Although the exact elements of nonperforming status can vary depending on the specific loan’s terms, “no payment” is usually defined as zero payments of either principal or interest.’… (Investopedia)

So that means that 38% of Aozora’s American Commercial properties in their portfolio are not paying the interest payments on the loans that they have ($719 Mill / $1.89 Bill = .38)!!! This, in my modest estimation, cannot be the only bank in the world that has a portfolio of non-performing commercial real estate loans. I believe that many banks are holding a big bag of virtually unmarketable dookie (💩) officially known as big city Commercial Real Estate.

Those many, many, many banks are holding the bag. And many, many, many custodians of your money (pensions, retirement and investment accounts) are holding the banks that are holding the bag.

Drops in valuation of this kind of magnitude last happened in residential real estate during/after the Great Financial Crisis of 2007-2008. The key word is -after-… In contrast, the Dow is the highest it has ever been while it is now the Commercial Real Estate that is cratering. So it looks like we are nowhere near a bottom for the unfolding breakdown of CRE and the DJIA has not even caught so much as a cold…yet.

Andy Schectman on a recent episode of Liberty and Finance made a case that Billionaires are selling large amounts of stock-Bezos (Amazon) is selling. Zuckerberg (Facebook) is selling. Crain’s Chicago Business reports that Discover CFO sells nearly all his company stock.

The truth is that the Billionaires -can- read the signs of the times. The question is; Can you see the signs (this is not financial advice)?

The issue of the undocumented hoards, helped by border states that are roundaboutly financed with US taxpayer money channeled through the UN and IOM (The International Organization for Migration) are negatively affecting the values of CRE in our major cities and beyond. The problem is that this dissolution of value in CRE is going beyond just the commercial properties themselves. It is going to affect the pensions, defined benefit, 401(k), 403(b) and investments that have ownership in this systemically important part of our economy. That means it is going to negatively affect virtually everyone invested in these instruments. That means that without taking evasive action-you, your family and your neighbors might well see a terrible drop in the value of your financial assets as they are just ground down to the point of being a welcome mat for Central Bank Digital Currency (CBDC). We can then expect complete control of your life and the ruination of your dreams and your posterity. This is the judgement of God on America. He is the only one truly worth trusting.

What can one do? Consider investing in -real- things that you can buy, hold and take possession of: Precious metals, food, water (filtration, purification and storage), shelter, energy (solar, generators etc.), and protection (being where a lot of people aren’t might be a good start). (This is not advice of any kind. Please consult a professional in the area of your need or interest).

This commercial real estate problem has the capability to become a ‘bigger short’ than the 2008 ‘Big Short’ described in the 2015 movie (The Big Short). Will you see this for what it is and get out of the way before it happens or will you still be licking your wounds when the movie comes out next time (if there is a next time)?

———-

If you appreciate this article can you consider a gift to Encouraging Angels for the intelligence we provided today? Click this link to give. We need the support. Links to this article are encouraged. Reproductions of this writing are only allowed by written permission of the author and those reproductions must include this proviso of request for support, how this writing may be reproduced and following disclaimers.

All rights reserved.

Stan Szymanski (or Encouraging Angels) is not a medical doctor. This is not medical advice. In all matters pertaining to the health and care of a human being consult a medical doctor. This is not legal, financial or personal advice. Consult appropriate professionals in those fields for that type of advice.