ENCOURAGING ANGELS: When You Buy a Stock or Bond You Don’t Own It-Who Does?

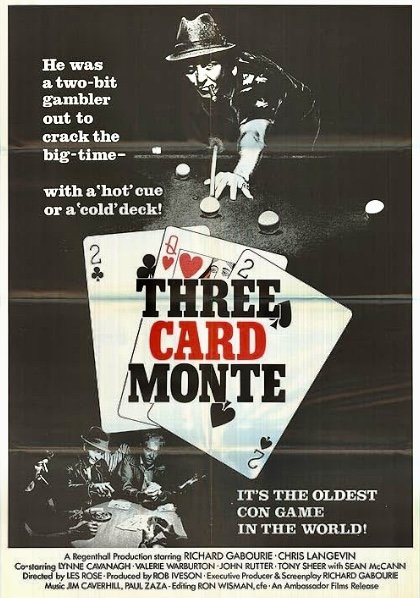

Photo Credit: IMDB

By Stan Szymanski

…’Regulators must equip themselves with tools such as “bail-in” bonds to deal quickly with a failed clearing house for stocks, bonds or derivatives without having to call on taxpayers for cash, the G20’s risk watchdog said on Thursday.’…(Reuters 4/25/24)

Why would a Clearing House fail? Because the assets as part of large trades that are being ‘cleared’ are contracts that for some reason (like a nuclear event or World War III) cannot be fulfilled and the contract fails.

The Depository Trust and Clearing Corporation (DTCC) is an American financial services company founded in 1999 that provides clearing and settlement services for the financial markets. This includes the settlement of large and largely unknown massive quantities of derivatives trades. Some estimates place the value of worldwide OTC derivatives at over $1 Quadrillion (>$1,000,000,000,000).

What are ‘Over The Counter’ derivatives?:

…’OTC-traded derivatives generally have a greater possibility of counterparty risk, which is the danger that one of the parties involved in the transaction might default. These contracts trade between two private parties and are unregulated. To hedge this risk, the investor could purchase a currency derivative to lock in a specific exchange rate. Derivatives that could be used to hedge this kind of risk include currency futures and currency swaps.’… (Investopedia)

When you see the word ‘currency’ when it comes to the United States just think US Treasury Bonds.

According to the Reuters article:

…’More recently, the United States has adopted rules to force more trades in the $26 trillion U.S. Treasury market through clearers.’…

Previously, these OTC Derivatives were settled between the parties who made the ‘bet’ between each other and were responsible for settling with each other privately.

So why would the US adopt rules to force more of the $26 Trillion of Treasury trades through the Clearing Houses like DTCC when they were not doing this before?

It is because they know what is coming, IMHO.

_____________________________

Please refer to our proviso at the end of the article regarding any reproduction of this writing (This especially means those who have modified my writing for their benefit and own financial gain as well as even plagaristically putting their name on my work) and consider a donation to Encouraging Angels today. We need your support—————————————-

The world as a whole is abandoning the US Dollar (Treasuries) as the world reserve currency. Countries of the world are sick and tired of having the currency of their country linked to the dollar and then seeing the same dollar weaponized through sanctions against anyone the U.S. doesn’t like anymore.

They are also sick of seeing the US able to literally print money out of thin air to fund their deficits and to get cheap assets in return for its (soon to be) worthless currency.

This is why countries are falling over themselves to join the BRICS nations. The BRICS nations are right now settling trade (like for oil) in the local currency of the trading partners, not the U.S. dollar. Soon the BRICS will bring forth a true competing world reserve currency based on commodities (most likely gold; perhaps silver, oil and other commodities as well).

So as the world abandons the US dollar (and therefore US Treasuries), the demand for US Bonds, Bills and Notes will dry up and fall.

If there were a large catastrophic event, like a nuclear exchange between nation states or a massive cyberattack on our infrastructure, it would precipitously accelerate a cataclysmic fall of the dollar-perhaps all the shouting will over in one trading day.

Triggered by this kind of event the price of US Treasury obligations will then fall lower than the drippings of Joey Brandon’s ice cream cone. The new settlement of these large derivatives trades and the US Treasury market will meet in the house of DTCC.

…’The Depository Trust & Clearing Corporation is the biggest bank in the world that you have probably never heard it. They happen to be the registered owners of 99% of all paper (stocks, bonds, securities, etc.). Scary, but true. And they have a perfectly good reason for it – with electronic trading, it is impossible to make timely changes to registered ownership of the paper.’…’The banks and brokers are merely custodians for their clients. By federal law (SEC), they cannot hold any assets in the customer’s name. The assets must be held in the name of DTC’s holding company, CEDE & Co. That’s how DTC has more than $19 trillion dollars of assets in trust… or is it really in “trust” if the private Federal Reserve System is technically holding it in their “unknown” entity’s name?…Obviously, if stock and bond certificates you’ve purchased aren’t in your name, then the “holder” (the Federal Reserve System) could theoretically refuse to surrender them back to you under a “national emergency” according to the Trading with the Enemy Act (as amended).’… (Seeking Alpha 10/2/08)

Here is where this affects you and your money.

The stock that you -think- you own is registered in the name of CEDE & Co. (DTCC’s holding company). They are the REGISTERED OWNER. The only way you can be a REGISTERED OWNER is to actually have a PHYSICAL CERTIFICATE issued with your name PHYSICALLY INSCRIBED on the certificate. I called a broker about a year ago and the cost for a physical certificate was $500(!) Absolutely ridiculous-it used to be free and took about six weeks (that was two decades ago before my daughter got sick when I was in the business…).

Regarding your money (assets) at a brokerage house (the stocks/bonds etc. that you -think- you own)-You are not a registered owner of those securities…you are a BENEFICIAL OWNER.

What is a BENEFICIAL OWNER?

…’BENEFICIAL OWNER- A Beneficial Owner is nothing more than a beneficiary, “One who is entitled to the benefit of a contract”- A Dictionary of Law, 1893. All book-entry stocks and bonds you purchase make you the beneficial owner, not the registered holder. The owner of a book-entry stock or bond is the entity or name that it is registered under.’…(Seeking Alpha 10/2/08)

So if we happen to on the precipice of World War, Nuclear War, Cyber War and Invasion and push comes to shove-what do you think will happen to the assets that are -not- in your name? Will they be given back to you as the ‘beneficial owner’ or will the ‘registered owner (CEDE and Co/DTCC)’ do what is best for them which will be to settle the trades of the huge derivatives positions that are now underwater because of a collapse in the US Treasury market?

I think that the answer is quite obvious, IMHO but here is an estimation of what -could- happen:

There could be a nuclear exchange that would immediately close all financial markets. The trades that pose the biggest problems are the large OTC derivatives trades that could/would cause systemic collapse of the financial system.

The Treasury market would enter a collapse since no one would trust the ability of the US to pay its bills as no one wants US Treasuries.

In an attempt to save the western financial system, DTCC as REGISTERED OWNERS of 99% of all securities (stocks, bonds, paper etc…) use the necessary paper assets of the BENEFICIAL OWNERS (you and me) to clear the imbalances in the large derivatives trades. This is when the ‘Bail-In’ bonds would be issued. This might ‘save’ the system at the complete expense of every (alleged) asset owning American. It would also bring on the ‘Greatest Depression’ ever seen by mankind. As Klaus Schwab has famously said: ‘You will own nothing and be happy’. I just don’t know about the happy part as within days roving bands of marauders would descend on you and yours to take whatever you have left as ‘Mad Max’ ensues…

What can you do (this is -not- financial advice-consult your financial professional)? Apparently/allegedly, you can still get a stock certificate for stocks…at a cost. About bonds you need to contact your broker..treasuries look like they are book entry only (electronic).

Consider owning physical things like food, water (and filtration/storage), shelter (a place in the mountains?), energy and protection. Consider PHYSICAL (not Wall Street paper) precious metals while they can still be had. Anything you do or consider comes with risks including market risks and risks of complete loss in value or householding/storage risks of any physical asset.

It is quite scary to consider the ramifications of who is actually in control of your life savings. Pray about how to move forward. The ‘powers that be’ are moving forward with their plans and in my opinion, it probably doesn’t include you.

———–

If you appreciate this article can you consider a gift to Encouraging Angels for the intelligence we provided today? Click this link to give. We need the support. Links to this article are encouraged. Reproductions of this writing are only allowed by written permission of the author and those reproductions must include this proviso of request for support, how this writing may be reproduced and following disclaimers.

All opinions are that of the authors and not necessarily that of Encouraging Angels.

All rights reserved.

Stan Szymanski (or Encouraging Angels) is not a medical doctor. This is not medical advice. In all matters pertaining to the health and care of a human being consult a medical doctor. This is not legal, financial or personal advice. Consult appropriate professionals in those fields for that type of advice