The First ‘Too Big To Fail’ Bank Credit Suisse Suffers as Collapse Expands

The First ‘Too Big To Fail’ Bank Credit Suisse Suffers One or More Bank Runs as Collapse of Trust in the Financial System Expands

By Stan Szymanski

25 days ago I wrote an article entitled ‘Banking Rhetoric During A Financial Collapse-The Song Remains the Same’. It was about the jawboning of the CEO of Credit Suisse who was trying to use ‘moral suasion’ to avoid a run on the banks’ assets. Just as the Captain of the Titanic believed the ship was unsinkable Credit Suisse CEO Ulrich Koerner opined:

…’I trust that you are not confusing our day-to-day stock price performance with the strong capital base and liquidity position of the bank’…

Today, Credit Suisse has hit an iceberg.

As reported by Zero Hedge:

…’On Thursday, Credit Suisse said one or more of its units (emphasis added) breached liquidity requirements this month when depositors pulled their money amid speculation about the lender’s turnaround plan.’…

ZH also expressed the opinion that …’if all it takes for your liquidity to fall below legal regulatory requirements are a few tweets, then you probably shouldn’t exist in the first place’…

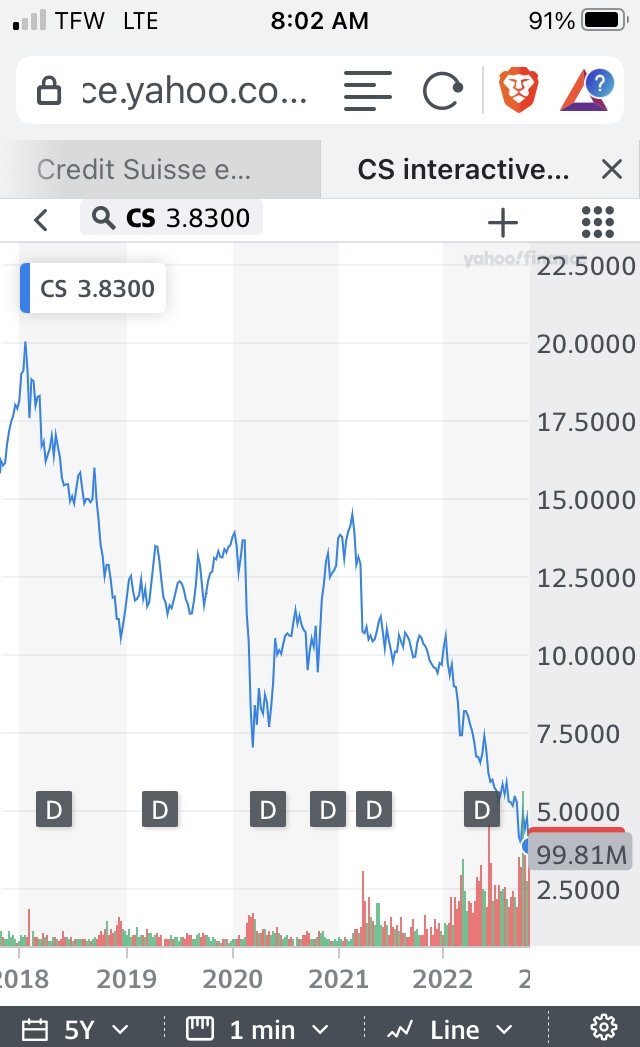

Quite right. And if one cares to take a look at the CS chart for its performance over the last 5 years, IMHO, it looks like a bankruptcy. Note the high volume and rapidly declining share price in 2022.

Chart credit: Yahoo Finance 8:02am 10/28/22

The rotten rhetoric of Credit Suisse was disinfected when the truth about the company became well known to the public through social media. The common folk then sanitized the narrative by voting with their feet by taking their money out of the bank.

This is not happening to a third world bank. This is happening to a ‘too big to fail’ financial institution.

According the the United States Gold Bureau:

…’Recently, the Swiss National Bank took $6.27B from the U.S. Federal Reserve swap line. The previous week, the Swiss National Bank took $3.1B. Both draws were more extensive than any draws made during the Covid pandemic.’…

They go on to state:

…’The Fed states, “swap lines are designed to improve liquidity conditions in dollar funding markets in the United States and abroad by providing foreign central banks with the capacity to deliver U.S. dollar funding to institutions in their jurisdictions during times of market stress…The swap lines support financial stability and serve as a prudent liquidity backstop.” The Swiss National Bank taking two substantial swap line positions two weeks in a row is a big red flag something is drastically wrong.’…

I think that we need to ask the question: Just how many dollars can the Fed provide as this problem spirals out of control-not just in Switzerland, but around the whole world?

Just two weeks ago I wrote Japanese 10 year Bonds Trade 1st Time in 5 Days-JGB 2 Year NOT Trading-Where There Is No Bid There Is No Market. When has the benchmark bond of a first world country -not- traded for four days? In the case of Japan not since the 10 year JGB became its benchmark in 1999. To reiterate: Where there is no bid (no buyers), there is no market.

Where there is no market, there -is- illiquidity. That means that there is no way to determine the price of an asset. Where there is no price discovery, what is an asset worth? Is it actually worth anything at all?

Before you comfort yourself in believing the hype of the western financial press about the touts of the ‘strong dollar’, the Treasury Secretary of the United States of America has something to tell you.

From Chief Investment Officer:

…’Reduced liquidity for bonds is getting to be a problem, according to Treasury Secretary Janet Yellen.

At a speech before the Securities Industry and Financial Markets Association annual meeting Tuesday, she reiterated an earlier observation that diminished ability to sell bonds is worrisome.’…

The United States of America is having trouble selling the bonds of the country who supposedly issues the world reserve currency! Why is this the case? Could it be that the Fed has finally printed so much money that it is now blatantly obvious the the ‘king has no clothes’? Could it be that sovereign countries and investors alike are, like the account holders at Credit Suisse, voting with their feet and jumping out of their US bond holdings like passengers jumping into a lifeboat (or even the icy waters) off of the Titanic?

What does this mean for world markets and you?

Credit Suisse may be the first public humiliation of the TBTF banks, but CS will surely not be the last. And indeed we are soon to see on the horizon the first sovereign western governments who have for so long depended on the ‘stability’ of the US dollar begin to capsize. The economies of Britain and Switzerland have been roiled by similar events in October.

Who is next to be tossed about on this sea of illiquidity? Will you vote with your feet before it is too late into the lifeboats of precious metals, commodities, food, energy and somewhere to lay your head that the bank cannot take away?

———-

If you appreciate this article can you consider a gift to Encouraging Angels for the intelligence we provided today? Click this link to give. We need the support. Links to this article are encouraged. Reproductions of this writing are only allowed by written permission of the author.

All rights reserved.

Stan Szymanski (or Encouraging Angels) is not a medical doctor. This is not medical advice. In all matters pertaining to the health and care of a human being consult a medical doctor. This is not legal, financial or personal advice. Consult appropriate professionals in those fields for that type of advice.

Share This Story, Choose Your Platform!

2 Comments

Comments are closed.

BAM! You nailed it again, Stan!

The vast majority of people have no clue as to the “Potemkin Village” of too-big-to-fail banks, their derivatives, and methods. It’s always privatize profit (“No! this is OUR money.”) and socialize debt (“If taxpayers don’t help us out with bail-outs, the sky will fall!”)

Having lived through the 2008 financial debacle and almost been wiped out by a “100% guaranteed investment” which turned out to be a derivative based upon a pool of derivatives all undisclosed to investors–please, know what’s going on.

Your investment can most easily be reduced to a single form you receive by mail: “Notice to Unsecured Creditor in Re: XYZ Corp., US Bankruptcy Court, Southern District of NY, Manhattan.” PS Then get ready to make numerous trips to NYC and hire a damn good bankruptcy trial attorney and firm (back in 2008, they were a bargain at $750/hr plus expenses.)

Cheers! I survived by the grace of God (ably assisted by trial counsel, who even deposed Lloyd’s of London in the UK shaking the surety and insurance tree.)

Thank you CC!…God bless you for keeping it together in the face of terrible odds and even more terrible people that populate the investment biz…the whole egg roll has yet to become undone…